BEIJING, Jan. 7 (Xinhua) -- For years, financing had been a head-scratcher for small pig farmers like Zhao Guanchao, especially when animal diseases and other unexpected events eat into profits and lead to liquidity strain.

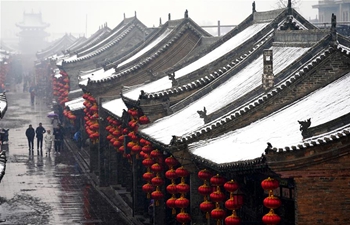

"Without money, our hands are tied; we have no choice but to sell our pigs because we can't afford the swine feed," said Zhao, owner of Jinxing Breed Company in Pingdingshan city of central China's Henan Province.

But the firm was able to survive what many considered as the toughest year for pig raisers in 2019 as African swine fever roiled the industry, bringing losses to farmers and exacerbating their financing difficulties.

With the help of Pingdingshan modern breed professional cooperative, a rural economic organization that provides financing, product match-making and training services for local small and medium-sized animal husbandry farms, Zhao managed to take out loans worth 9 million yuan (about 129,000 U.S. dollars).

As early as 2016, the cooperative has teamed up with JD Finance, a financial subsidiary of China's e-commerce giant JD.com, and an insurance firm to provide farms with loans. After a thorough examination of the credit profile of each pig farmer, the cooperative would provide a guarantee, allowing the farmers to receive loans.

Since last August, the cooperative has supported about 25 farming firms to obtain loans, with the combined capital raised reaching 100 million yuan, said Du Qunxing, deputy general manager of the cooperative.

The model pioneered by the rural cooperative is part of the country's ongoing efforts to ease pig farmers' financing strain to restore pork supply after outbreaks of African swine fever significantly reduced the number of pigs in stock.

In September, the finance and agricultural authorities jointly released a notice, outlining policies to support hog production, including subsidized loans, incentives to major hog producing counties and allowances to farms with culled pigs.

In the same month, China's banking and insurance regulator urged institutions to provide innovative financing products and services to pig farmers, expand the kinds of collaterals, and increase insurance coverage on hogs.

Such financing will be important for small-scale pig farms to restore production and upgrade pigpens in the wake of the swine fever and help the industry better guard against the unforeseen, said Zhu Zengyong, a researcher with the Chinese Academy of Agricultural Sciences (CAAS).

Chang Xianyun, the owner of a pig farm in Neixiang county of Nanyang city, Henan Province, said that she took good advantage of the two-million-yuan loans obtained through her local rural cooperative.

"Most of my loans will be spent on equipment upgrading and purchasing more piglets so I can better prevent pig diseases and expand my business," Chang said, adding that she and another 12 local farmers took out loans worth 12 million yuan through the cooperative last year.

Continued efforts should be made to increase subsidized loans and allow a wider range of collaterals so that finance can better facilitate the development of the pig-farming industry, said Wang Zuli, a researcher from CAAS.